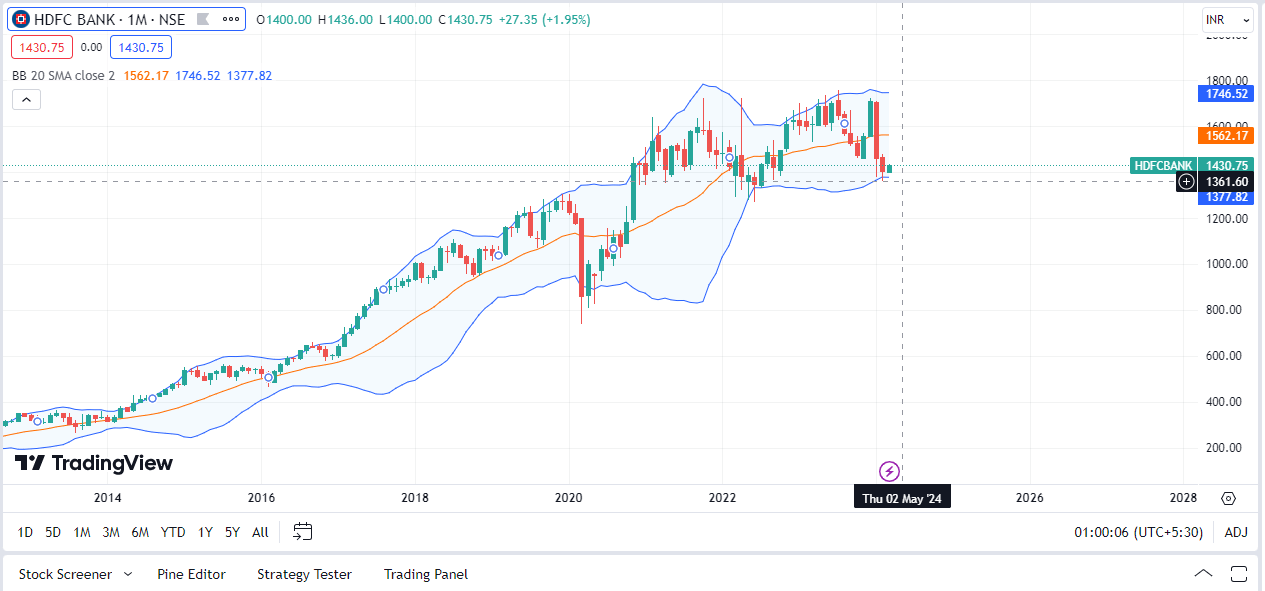

Hello Friends, today we will talk about HDFC Bank Share Price Target 2024, 2025, 2026, 2027, 2030.

Today we will try to know in which direction the performance of this excellent bank of the country’s largest private sector has the potential to go in the coming years. The way the performance of the bank seems to be getting stronger every year, due to this, investors are fully expecting to show good performance in the future as well.

Today we will analyze the full details of HDFC Bank’s business as well as look at the business opportunities of the future, which will give us a little more idea of how much the HDFC Bank Share Price Target is capable of showing in the coming time. Let’s analyze in detail: –

HDFC Bank Share Price Target

HDFC Bank is one of the largest private sector banks in the country. For any bank, the CASA ratio is considered to be the most important for the growth of the brokerage business, because it allows the company to earn a good income from interest by giving loans to other customers.

If you look at the CASA ratio of HDFC Bank, it is always seen to be around 40 percent, which is considered very good. Due to such a good CASA ratio with the bank, more and more people are seen earning good profits by giving loans with good interest rates and this is also improving the business of the bank every year.

If you look at the HDFC Bank Share Price Target 2024, then you can expect to see the first target of Rs 1600 along with giving excellent returns. After this target, you are soon going to see the second target of Rs 1700.

To Also Read:- Reliance Share Price Target 2024

HDFC Bank Share Price Target 2024

| HDFC BANK Share Price Target 2024 |

Price |

|---|---|

| January 2024 | 1400 |

| February 2024 | 1390 |

| March 2024 | 1420 |

| April 2024 | 1480 |

| May 2024 | 1510 |

| June 2024 | 1550 |

| July 2024 | 1590 |

| August 2024 | 1620 |

| September 2024 | 1660 |

| October 2024 | 1680 |

| November 2024 | 1700 |

| December 2024 | 1710 |

Fundamentals of HDFC Bank Share

HDFC BANK long-term financial performance has generally been positive। With steady revenue growth and profitability, the company has consistently shown strong financial results।

Company Name |

HDFC BANK |

|---|---|

| Primary Exchange | NSE, BSE |

| Face Value | ₹ 1.0 |

| Dividend Yield | 0.84% |

| TTM PE Ratio | 18.41 |

| PB Ratio | 3.74 |

| Promoter Holding | 0% |

| Book Value | ₹ 519 |

| Market Cap |

10,86,857 Cr |

| Current Price |

₹ 1,528.60 |

HDFC Bank Share Target 2025

HDFC Bank has a very strong branch network across the country, with the help of which the bank has been able to spread its best banking service with great strength. At present, the bank has a network of about 24000 banking outlets and more than 18000 ATMs across the country.

The entire focus of the management is to spread its best banking service to every village and city of the country within the coming time, for this the company is seen opening its branches in almost every small village and city. As the company expands its branch network, it can be fully expected that the bank’s business is also going to benefit from it.

As the bank’s branch network increases, the HDFC Bank Share Price Target by 2025 is seen, along with earning you the best return, you can definitely see the first target of Rs 1900. After that, you can definitely stop for the second target to be Rs 2100 interest.

| HDFC Bank Share Price Target |

Price |

|---|---|

| January 2025 | 1750 |

| February 2025 | 1780 |

| March 2025 | 1910 |

| April 2025 | 1950 |

| May 2025 | 1970 |

| June 2025 | 1990 |

| July 2025 | 2020 |

| August 2025 | 2080 |

| September 2025 | 2110 |

| October 2025 | 2150 |

| November 2025 | 2180 |

| December 2025 | 2220 |

HDFC Bank Share Price Target 2026

HDFC Bank is the number one private sector bank in the country in terms of NPAs. The bank has diversified its loan book very well, due to which HDFC Bank is able to keep its NPAs under control very easily and this allows the business to grow very well.

HDFC Bank does not lend at all in the company sinking in the cycle of high interest to grow its business rapidly, gives more and more loans to those companies whose performance is good and the possibility of large NPAs is very low. Along with this, the bank is seen gradually diverting small amounts of loans towards retail loans to keep its NPA in control, it can be expected that the bank’s NPA is definitely going to see its improvement.

If you look at the HDFC Bank Share Price Target by 2026, then you can see the first target showing Rs 2300 along with earning good returns. And then you can definitely think of holding the second target for Rs 2650.

HDFC Bank Share Price Target by 2027-2030

It has always been seen that HDFC Bank is trying its best to provide better banking services to its customers by adopting new technology in its business. They are seen making changes in their service from the customer’s point of view, whether it is in digital payment or any kind of online banking facility, they are seen keeping themselves updated from everywhere.

HDFC Bank offers a host of services to its customers to keep them updated with the latest technology. In the coming time, HDFC Bank is seen working in partnership with different companies to improve its digital banking segment, it can be expected that the bank will definitely benefit in the coming time.

We will continue to improve our digital banking services If you look at the HDFC Bank Share Price Target by 2027, – 2030 then you can see the first target of 2027 Rs 3100 along with earning very good returns. After having this target interest,

Risk Factors

HDFC Bank’s Share Price is a publicly traded stock and can be affected by various risk factors. Here are the common risk factors that are sometimes found,

Government Policies: Changes in government policies can affect the share price.

The global crisis: A global crisis is another risk that can affect any company in the world.

Note: – You should think before investing. Any goals mentioned on this website are taken by our personal analysis, and we are not SEBI registered consultants, our purpose is only to provide detailed information related to the company’s business to the public. Always consult your financial advisor before making any Fund investment decisions.