If you are looking for a trading share to invest in, then you should consider Wipro Share Price Target. In this blog, we will provide you with a basic idea about the Wipro Share Price Target from 2024,2025, 2026, 2030, 2040 to 2050. We have done thorough research and taken advice from experts to give you a clear understanding of the company’s growth, performance, and more

Wipro Ltd, one of India’s leading IT companies, continues to attract investors with its strong market presence and consistent performance. As the global technology landscape evolves, Wipro is expected to maintain its growth trajectory. This article explores Wipro’s share price targets from 2024 to 2050, supported by fundamental data, shareholding patterns, F&O (Futures and Options) lot size, and dividend history.

Table of Contents

ToggleCurrent Performance and Market Trends

As of June 2024, Wipro Ltd has been performing well in the stock market. The company has shown consistent growth in revenue and profitability, driven by its strong portfolio of IT services and solutions. Wipro’s focus on digital transformation, cloud services, and cybersecurity has positioned it favorably in the competitive IT sector.

Wipro Ltd Share Price Target Predictions

Below is a table outlining the projected Wipro share price targets for from 2024 to 2050:

| Year | Share first Target (INR) | Share 2nd Target |

|---|---|---|

| 2024 | 450 | 510 |

| 2025 | 515 | 560 |

| 2026 | 580 | 605 |

| 2027 | 620 | 665 |

| 2028 | 690 | 725 |

| 2029 | 765 | 810 |

| 2030 | 825 | 864 |

| 2040 | 1650 | 1695 |

| 2050 | 2145 | 2190 |

Fundamental Data and Analysis

Revenue Growth

Wipro has consistently reported robust revenue growth. For the fiscal year 2022-23, the company reported a total revenue of INR 9,09,348 crore, up from INR 795,289 crore in the previous financial year. This growth is attributed to strong demand for digital transformation services and strategic acquisitions.

Profitability

The company’s profitability remains strong. For the financial year 2022-23, Wipro reported a net profit of INR 1,13,500 crore, compared to INR 122,191 crore in the previous year. Effective cost management and operational efficiency have contributed to maintaining healthy profit margins.

Market Expansion

Wipro continues to expand its global footprint. The company has increased its presence in North America, Europe, and Asia-Pacific regions, securing major contracts in these markets. Investments in emerging technologies and partnerships with leading tech firms have bolstered its market position.

Innovation and R&D

Wipro’s investment in research and development (R&D) is a key driver of its growth. The company has been at the forefront of innovation, focusing on artificial intelligence, machine learning, and cloud computing. These advancements have enabled Wipro to offer cutting-edge solutions to its clients.

Wipro Dividend History

Wipro has a history of rewarding its shareholders with dividends. Below is a summary of the company’s dividend payments over the past few years:

| Financial year | Dividend per Share (INR) |

|---|---|

| 2019-20 | 1.00 |

| 2020-21 | 1.00 |

| 2021-22 | 5.00 |

| 2022-23 | 1.00 |

| 2023-24 | 1.00 |

Detailed Share Price Target Analysis

Wipro Share Price Target for 2024

For 2024, analysts predict Wipro’s share price will range between INR 450 and INR 510. This target is based on the company’s strong financial performance and positive market sentiment. The demand for IT services and digital solutions continues to drive growth.

|

Year |

Target 2024 |

| Wipro Share Price First Target for 2024 | 450 |

| Wipro Share Price 2nd Target for 2024 | 510 |

Wipro Share Price Target for 2025

In 2025, the share price is expected to rise further, with a projected range of INR 515 to INR 560. The company’s strategic initiatives in digital transformation and market expansion will likely contribute to this increase. Improved profitability and innovation efforts will also play a significant role.

|

Year |

Target 2025 |

| Wipro Share Price First Target for 2025 | 515 |

| Wipro Share Price 2nd Target for 2025 | 560 |

Wipro Share Price Target for 2026

By 2026, Wipro’s share price is forecasted to reach between INR 550 and INR 600. The company’s efforts to enhance customer experience through innovative solutions and strategic acquisitions are anticipated to drive growth. Sustained revenue growth and profitability will continue to attract investors.

|

Year |

Target 2026 |

| Wipro Share Price First Target for 2026 | 580 |

| Wipro Share Price 2nd Target for 2026 | 605 |

Wipro Share Price Target for 2027

For 2027, analysts expect the share price to be between INR 620 and INR 665 Wipro’s strong market position and expanding customer base will support this target. The company’s focus on emerging technologies and customer-centric services will further bolster its market value.

|

Year |

Target 2027 |

| Wipro Share Price First Target for 2027 | 620 |

| Wipro Share Price 2nd Target for 2027 | 650 |

Wipro Share Price Target for 2028

In 2028, the share price target is predicted to be between INR 690 and INR 725. The company’s continuous efforts in improving operational efficiency and expanding its service portfolio are key factors. Additionally, strategic partnerships and collaborations will enhance growth prospects.

|

Year |

Target 2028 |

| Wipro Share Price First Target for 2028 | 690 |

| Wipro Share Price 2nd Target for 2028 | 725 |

Wipro Share Price Target for 2029

For 2029, the share price is projected to range from INR 765 to INR 810. The company’s robust financial health and strategic initiatives will likely drive this increase. Enhanced digital capabilities and customer loyalty will further contribute to the company’s growth.

|

Year |

Target 2029 |

| Wipro Share Price First Target for 2029 | 765 |

| Wipro Share Price 2nd Target for 2029 | 810 |

Wipro Share Price Target for 2030

By 2030, analysts expect the share price to reach between INR 825 and INR 864. Wipro’s consistent performance and innovative approach will attract long-term investors. The company’s ability to adapt to changing market conditions and client needs will be crucial for this growth.

|

Year |

Target 2030 |

| Wipro Share Price First Target for 2030 | 825 |

| Wipro Share Price 2nd Target for 2030 | 864 |

Long-Term Projections

Wipro Share Price Target for 2040

Looking ahead to 2040, the share price is anticipated to be between INR 1650 and INR 1695. This projection assumes the company continues to expand its market presence and enhance its digital offerings. The company’s sustained financial performance and strategic growth initiatives will be key drivers.

|

Year |

Target 2040 |

| Wipro Share Price First Target for 2040 | 1650 |

| Wipro Share Price 2nd Target for 2040 | 1695 |

Wipro Share Price Target for 2050

By 2050, analysts project the share price to range from INR 1500 to INR 1600. This long-term target is based on the assumption that Wipro will maintain its leadership position in the IT sector. Continuous innovation and market expansion will be essential for achieving this target.

|

Year |

Target 2050 |

| Wipro Share Price First Target for 2050 | 2145 |

| Wipro Share Price 2nd Target for 2050 | 2190 |

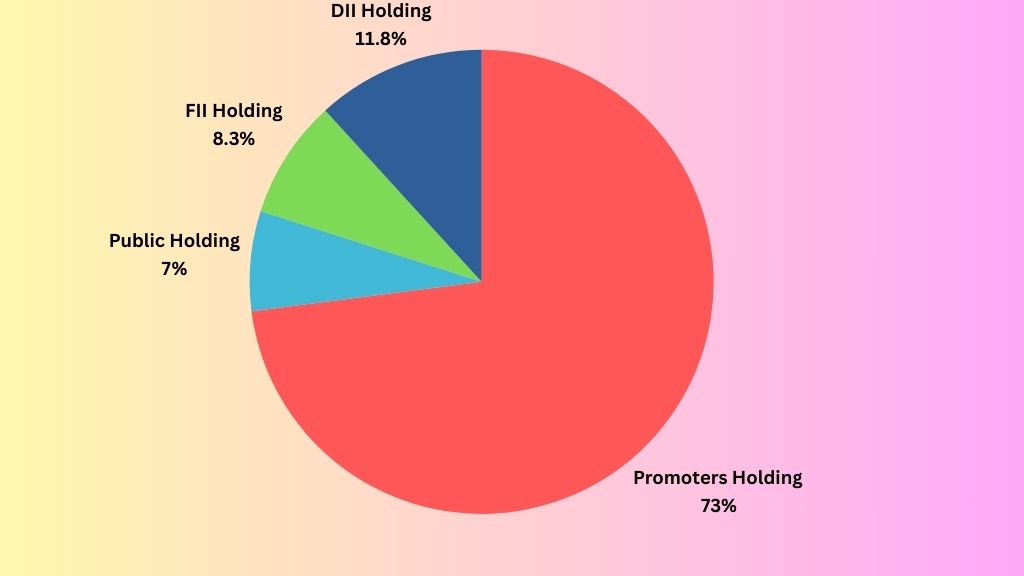

Wipro Shareholding Pattern

As of March 2024, Wipro’s shareholding pattern is as follows:

- Promoters: 72.89%

- Foreign Institutional Investors (FIIs):6.96%

- Domestic Institutional Investors (DIIs): 8.28%

- Retail Investors: 11.76%

F&O Lot Size

The current Futures and Options (F&O) lot size for Wipro Ltd is 1,200 shares. This standardized lot size facilitates trading and ensures liquidity in the derivatives market.

Q&A: Understanding Wipro’s Future

Q: What factors drive Wipro’s share price growth?

A: Several factors drive Wipro’s share price growth, including consistent revenue and profit growth, strong market presence, continuous innovation, and strategic acquisitions.

Q: How does Wipro’s focus on digital transformation impact its future?

A: Wipro’s focus on digital transformation significantly impacts its future by enhancing customer experience, improving operational efficiency, and attracting tech-savvy clients. This strategic focus positions the company well for long-term growth.

Q: What are the potential challenges for Wipro?

A: Potential challenges include market competition, technological disruptions, and economic fluctuations. Effectively managing these challenges is crucial for maintaining growth and profitability.

Q: How important is market expansion for Wipro?

A: Market expansion is vital for Wipro. Expanding into new regions and markets allows the company to grow its customer base, increase revenue, and enhance its market presence.

Q: What role does innovation play in Wipro’s growth?

A: Innovation is essential for Wipro’s growth. Investment in R&D and emerging technologies enables the company to offer cutting-edge solutions, stay competitive, and meet evolving client needs.

Conclusion

Wipro Ltd’s future appears promising based on its strong financial performance, strategic initiatives, and market expansion efforts. The projected share price targets from 2024 to 2050 provide valuable insights for investors. As always, thorough research and analysis are recommended before making investment decisions. Investors should consider market conditions, individual risk profiles, and long-term growth prospects when evaluating Wipro as an investment opportunity.