Tata Power, one of India’s leading power companies, is a key player in the energy sector. Investors are keen to know the future price targets of Tata Power shares. Predicting future prices is complex. However, by analyzing current trends and company performance, we can make educated guesses about Tata Power share price targets from 2024 to 2050.

Current Performance and Market Trends

As of June 2024, Tata Power’s shares are performing well. The stock has shown resilience despite market fluctuations. Several factors contribute to this stability. Tata Power’s consistent revenue growth, strategic initiatives in renewable energy, and strong management are key. The company is expanding its renewable energy portfolio and investing in advanced technologies.

Tata Power Share Price Company Overview

Company Name |

Tata Power |

| Market Cap | ₹ 1,41,729 Cr. |

| Primary Exchange | BSE. NSE |

| Face Value | ₹ 1.0 |

| Dividend Yield | 0.45 % |

| TTM PE Ratio | 40.3 |

| PB Ratio | 3.45 |

| Promoter Holding | 46.86% |

| Book Value | ₹101 |

| Current Price | ₹ 444 |

| 52 Week Low | ₹464 |

| 52 Week High | ₹ 216 |

Tata Power Share Price Target for 2024

For 2024, analysts predict Tata Power’s share price will see moderate growth. The target range is between INR 450 and INR 470. This forecast is based on strong quarterly earnings and the company’s continued investment in renewable energy. Tata Power’s efforts to optimize operations and reduce costs will also support this growth.

| Year | Target 2024 |

| Tata Power Share Price First Target 2024 | ₹450 |

| Tata Power Share Price Second Target 2024 | ₹470 |

Tata Power Share Price Target for 2025

In 2025, Tata Power’s share price is expected to rise further. The predicted target range is between INR 580 and INR 600. This increase is due to several factors. The global shift towards renewable energy is projected to grow. Tata Power’s strategic partnerships with other energy companies are expected to yield positive results. The company’s initiatives in digital transformation and sustainable practices will enhance its market position.

| Year | Target 2024 |

| Tata Power Share Price First Target 2025 | ₹580 |

| Tata Power Share Price Second Target 2024 | ₹600 |

Tata Power Share Price Target for 2026

For 2026, the share price target is estimated to be between INR 720 and INR 740. Tata Power is likely to benefit from new renewable energy projects and technological advancements. The company’s focus on sustainability and efficient operations will attract more investors.

| Year | Target 2024 |

| Tata Power Share Price First Target 2026 | ₹720 |

| Tata Power Share Price Second Target 2026 | ₹740 |

Tata Power Share Price Target for 2027

By 2027, Tata Power’s share price target is expected to be more ambitious. Analysts estimate it could reach between INR 860 and INR 880. This projection is based on the company’s long-term growth strategies. Tata Power’s expansion into new energy markets and development of new projects will play a significant role. Moreover, advancements in energy storage and smart grid technology will boost investor confidence.

| Year | Target 2024 |

| Tata Power Share Price First Target 2027 | ₹860 |

| Tata Power Share Price Second Target 2027 | ₹880 |

Tata Power Share Price Target for 2028

In 2028, the share price target for Tata Power is predicted to be between INR 900 and INR 940. The continued global focus on renewable energy and sustainability will drive the demand for Tata Power’s services. The company’s strategic investments in energy efficiency projects will also support this growth.

| Year | Target 2024 |

| Tata Power Share Price First Target 2028 | ₹900 |

| Tata Power Share Price Second Target 2028 | ₹940 |

Tata Power Share Price Target for 2029

For 2029, the share price target is expected to range between INR 1040 and INR 1060. Tata Power’s ability to maintain high operational standards and its focus on sustainability will enhance its market appeal. The company’s commitment to corporate social responsibility will attract more investors.

| Year | Target 2024 |

| Tata Power Share Price First Target 2029 | ₹1040 |

| Tata Power Share Price Second Target 2029 | ₹1060 |

Tata Power Share Price Target for 2030

The forecast for 2030 is even more optimistic. Tata Power’s share price could potentially reach between INR 1280 and INR 1300. The ongoing shift towards renewable energy, especially in emerging markets, will increase the demand for Tata Power’s services. Tata Power’s strategic initiatives and technological advancements will be crucial for this growth.

| Year | Target 2024 |

| Tata Power Share Price First Target 2030 | ₹1280 |

| Tata Power Share Price Second Target 2030 | ₹1300 |

Tata Power Share Price Target for 2040

Looking ahead to 2040, predicting share prices becomes more challenging. However, if Tata Power continues on its current path, the share price could range between INR 2100 and INR 2150. This long-term forecast assumes Tata Power will successfully navigate potential challenges like regulatory changes and market competition. The company’s continuous innovation and adaptation to new technologies will be essential.

| Year | Target 2024 |

| Tata Power Share Price First Target 2040 | ₹2100 |

| Tata Power Share Price Second Target 2040 | ₹2150 |

Tata Power Share Price Target for 2050

For 2050, the share price target is speculative. However, with consistent performance and strategic growth, Tata Power’s share price could potentially reach between INR 3500 and INR 3550. This assumes the company remains a leader in the energy sector and continues to innovate and expand. Tata Power’s role in the global renewable energy transition will likely strengthen its market position.

| Year | Target 2024 |

| Tata Power Share Price First Target 2050 | ₹3500 |

| Tata Power Share Price Second Target 2050 | ₹3550 |

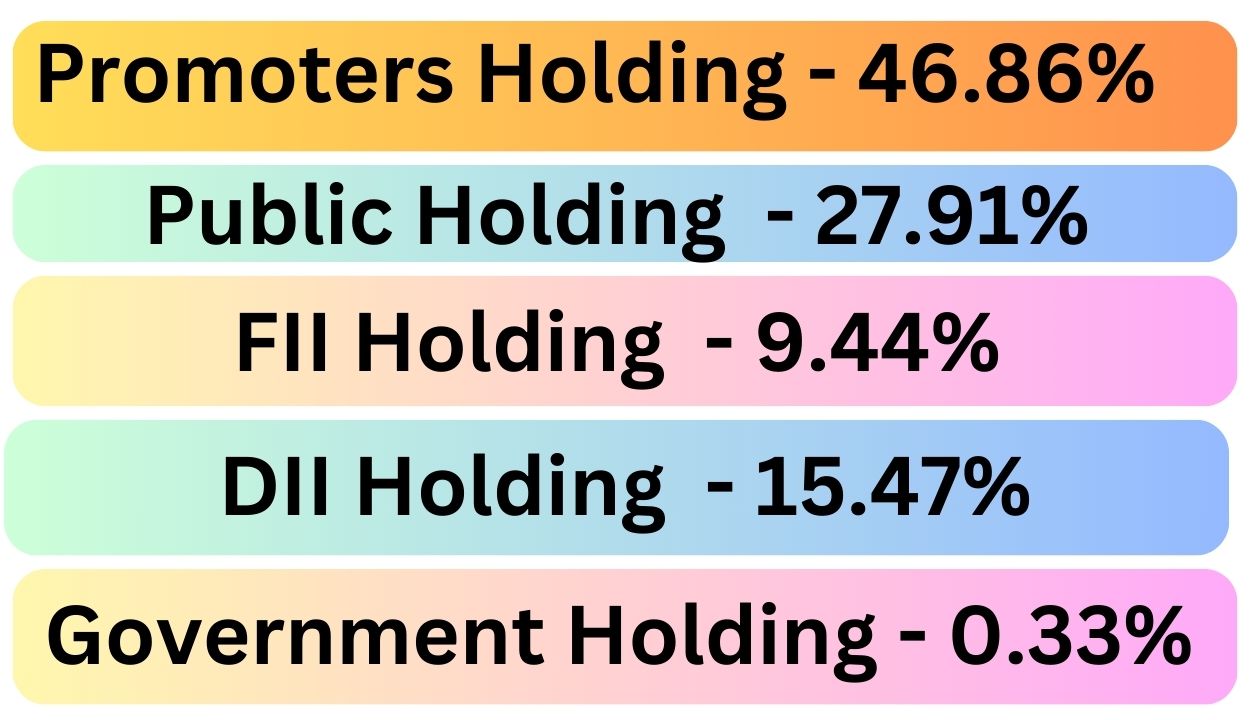

Tata Power Shareholding pattern

Promoters Holding

Promoter holding refers to the amount of capital invested by the owner of a company about the overall capital. In the case of Tata Power Share, the promoter holding capacity is 46.86%

Public Holding

Public investors are individuals who invest in the public market to make a profit in the future, by investing in both large and small companies. In the case of Tata Power Share, the public holding capacity is 27.91%.

FII Holding (Foreign Institutional Investors)

Foreign Institutional Investors (FIIs) are large companies that invest in companies located in different countries. In the case of Tata Power Share, the FII holding capacity is 44.77%

DII Holding (Domestic Institutional Investors)

Domestic Institutional Investors (DIIs) are institutions such as insurance companies and mutual funds that invest in companies within their own country. In the case of Tata Power Share, the DII holding capacity is 15.47%.

Government Holding

Government holding refers to the amount of capital invested by the Indian govt in a company’s overall capital. In the case of Tata Power Share, the Government holding capacity is 0.33%

Factors Influencing Tata Power’s Share Price

Several factors will influence Tata Power’s share price in the coming years:

- Global Demand for Renewable Energy: The increasing shift towards renewable energy sources will directly impact Tata Power’s performance and share price.

- Technological Advancements: Tata Power’s adoption of advanced energy technologies, such as energy storage and smart grids, will improve operational efficiency and reduce costs, positively affecting its share price.

- Regulatory Environment: Government policies on energy and environmental regulations will play a significant role. Favorable policies could boost Tata Power’s growth, while stringent regulations might pose challenges.

- Sustainability Initiatives: Tata Power’s commitment to sustainable energy practices and reducing its carbon footprint will attract environmentally conscious investors, enhancing its market appeal.

- Market Competition: The competitive landscape in the energy sector will also influence Tata Power’s share price. The company’s ability to stay ahead of its competitors will be crucial.

Conclusion

Tata Power’s future looks promising based on current trends and projections. Investors should monitor the factors influencing the energy sector and Tata Power’s strategic initiatives. While predicting exact share prices is difficult, the targets for 2024 to 2050 provide a useful guide for potential growth. As always, investors should conduct thorough research and consider market conditions before making investment decisions.